tax avoidance vs tax evasion examples

Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of tax evasion. On the other hand tax avoidance is an option that most people do to minimize their income tax return by claiming tax adjustments or credits using lawful and legal methods.

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden.

. LO7Tax avoidance is discouraged by the courts and Congress Is this statement true or false. Keeping accurate and organized records E. The following are the contrast in between tax avoidance and evasion.

Tax deferral is a method by which you can shift your taxable income in future years. This includes not paying taxes you owe even though your income is reported. When you see a commercial for a charity on television that mentions a tax-deductible donation that is an example of an opportunity for tax avoidance.

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law. Tax avoidance is legal across the country. This is a criminal act that when captured will result in prosecution.

Tax Evasion vs Tax Avoidance vs Tax Planning As we know tax evasion is an illegal and unethical practice of an individual or firm to escape from paying fair taxes to the government. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. If income is not reported by someone authorities do not possess a tax claim on them.

On the contrary tax planning is a systematic and legal process of using an entitys permissible exemptions deductions and other lawful provisions to curtail. The consequences of tax evasion can be serious. However if the assets are hidden after a tax liability has become due and owing this is an attempt to evade payment.

Here are some examples of tax evasion. Federal income tax than necessary because they misunderstand tax laws and fail to keep good records. Tax Avoidance vs Tax Evasion.

What are the rewards of tax evasion. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax fraud especially in the realm of international and offshore tax aka Tax Evasion. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes.

This is one of the most common tax evasion examples. Giving to charity as discussed above is one of the most common. Keeping a tip log B.

Tax evasion and tax avoidance are two terms which aim to fulfil a common purpose ie. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. To decrease the sum of tax from an individual or a legal persons income.

Person determines whether the tax planning activities they are. Some common examples of tax avoidance include. The other one is the evasion of payment.

Not reporting interest earned on loans C. There are basically three methods of reducing the tax bill viz tax avoidance tax deferral tax evasion. 1 Keeping a log of business expenses.

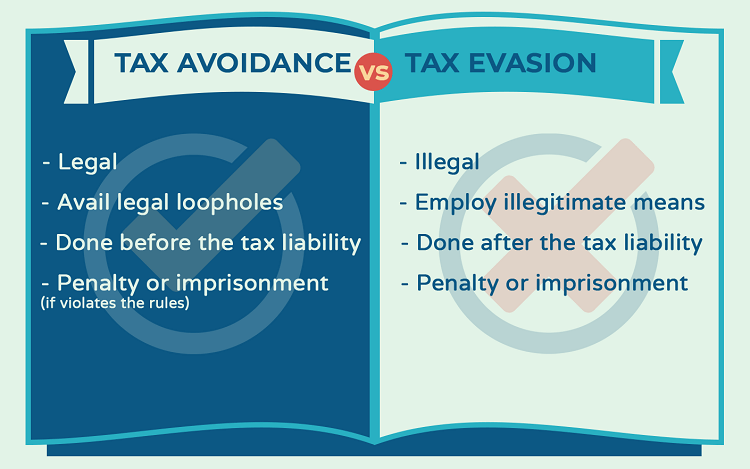

Tax evasion involves taking an affirmative act or deliberate step to make things seem other than what they are according to the IRS. Mailing tax forms on time C. In legal terms there is a big difference between tax avoidance and tax evasion.

Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of their lower tax band. LO7What are the rewards of tax avoidance. Tax evasion occurs when the taxpayer either evades assessment or evades payment.

There are a number of prominent examples of tax avoidance. Tax evasion is often confused with tax avoidance. Tax Avoidance Examples.

Tax avoidance is structuring your affairs so that you pay the least amount of tax due. In few countries this word tax. The IRS has rules about cryptocurrencies and their transactions are taxable.

When you make a donation to charity you get to. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. This often affects people with rental properties overseas.

Tax evasion is taking illegal steps to avoid paying tax eg. Tax avoidance involves not paying taxes according to legitimate legal rules. Activity 1 Circle each example of tax evasion.

Though these methods fulfil the same purpose one method aims to fulfil the purpose in a legitimate manner and another in an illegitimate manner. 1 Ignoring overseas income. 6 Tax evasion can result in penalties and the IRS will certainly pursue the taxpayer for any back taxes.

To assess your answers click the Check My Answers button at the bottom of the page. Can you go to jail for tax avoidance. Ignoring earnings for pet-sitting.

Often taxpayers can overlook their cryptocurrency holdings that have increased in value. Tax evasion is an illegal method to reduce the taxable income. For example if someone transfers assets to prevent the IRS from determining their actual tax liability there is an attempted to evade assessment.

Tax avoidance is a legal method to reduce your tax liability to comply with the provisions of tax laws. Examples of tax avoidance. 2 Banking on Bitcoin.

Ad The Leading Online Publisher of National and State-specific Legal Documents. What types of tax planning strategies may these doctrines inhibit. An example could be the directors of family-owned service not declaring cash sales.

Not declaring income to the taxman. Tax evasion is an illegal and fraudulent activity that aims to avoid paying taxes. What is tax evasion.

Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or intentionally underpaying taxes. Ignoring earnings for pet-sitting D. Tax evasion is lying on your income tax form or.

LO7What is the difference between tax avoidance and tax evasion. Tax Evasion vs Tax Avoidance. Legality Evasion is the prohibited control of organisation affairs to leave tax.

An example of tax avoidance is a situation where a person owns a business and employs his or her spouse. Some may only pay a part of their taxes and leave out the rest. Examples of tax evasion.

A Closer Look Tax Credit Vs Tax Deduction Taxcredit Taxdeduction Tax Credits Business Tax Tax Deductions

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Avoidance Vs Tax Evasion Infographic Fincor

5 Common Mistakes Taxpayers Commit Every Tax Season Taxpayers Taxseason Tax Season Tax Forms Tax Services

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

What S The Difference Between Tax Avoidance And Tax Evasion How To Plan Business Template Helping People

Tax Evasion Tax Avoidance Definition Comparison For Kids

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning